When we talk about blockchain technology, Bitcoin and cryptocurrency are the two most common use cases that come to mind. After that, multiple implementations were created. One of which is Ethereum by the Ethereum Foundation, giving us access to smart contracts, apps, and an independent blockchain along with improved presentation for our blockchain-based applications. Today blockchain, a decentralized network’s chain of comparable unchangeable blocks, is revolutionizing almost every industry. It stands as a transformative force.

Table of Contents

Let’s understand blockchain technology

- Blockchain is a digital record of transactions across a distributed network.

- The data is grouped into blocks and chained together cryptographically.

- Each block contains a timestamp, a link to the previous block, and the data itself.

- Blocks on the blockchain can be modified only by changing connected Blocks.

- As there is no single-point failure, data tempering is not possible.

The sheer security and transparency that come with blockchain technology have made it a preferred choice for many across segments. Blockchain Technology has left its mark on every industrial segment including Real Estate.

The real estate sector traditionally has been vulnerable in its dealing with data. The advent of a technology like blockchain is a blessing for real estate folks. Imagine a world where buying and selling property is easy as a breeze. Paperwork vanishes, and security reigns supreme. This isn’t a futuristic fantasy; it’s the reality blockchain technology promises.

Blockchain is elementally changing the way real estate transactions are conducted and recorded. Blockchain is no longer a buzzword. It is revolutionizing how we buy, sell, and manage property, leaving a trail of transparency, efficiency, and trust in its wake.

Blockchain in Real Estate

- Blockchain streamlines real estate processes; regulation, financing, listing, etc.

- Decentralized records and network-verified transactions remove centralized control.

- Blockchain gives all participants real-time access to identical transaction data.

- Transparency becomes key to overcoming traditional inefficiencies in real estate.

- Transactions are streamlined, fraud is non-existent, and transparency is ever-high.

- Blockchain tokenization enables fractional ownership and liquidity in illiquid markets.

- It can also facilitate peer-to-peer financing for the purchase of real estate assets.

- Blockchain also reduces the need for intermediaries like brokers, lawyers, and banks.

- It creates new opportunities for investment and funding in real estate.

Challenges of Traditional Real Estate Transactions

Traditional real estate transactions are plagued by many challenges impeding efficiency and transparency.

Conventional processes involve a multitude of intermediaries. It becomes hard for the parties involved to have a clear, real-time view of transactional data. This opacity slows down the entire process and breeds ground for errors and disputes. With multiple intermediaries involved, establishing and maintaining trust becomes a precarious challenge as well.

Legal fees, administrative expenses, and intermediary charges escalate in traditional real estate processes, placing a financial burden on both buyers and sellers. These exorbitant costs, combined with the prolonged timelines, make real estate transactions less accessible and more cumbersome for participants. Furthermore, lengthy paperwork, redundant processes, and manual verifications contribute to delays and increased operational costs.

The risks of fraud and errors are extremely high in traditional real estate transactions. Paper-based processes are susceptible to manipulation, unauthorized alterations, and fraudulent activities. The lack of a secure and tamper-proof system is threatening the validity of property records and ownership.

In essence, the challenges in traditional real estate transactions incorporate transparency issues, operational inefficiencies, trust deficits, high costs, and susceptibility to fraud – all pointing toward the urgent need for a fundamental change in the industry.

Real estate market challenges can impact investors and the economy, yet the right strategies can overcome these and ensure continued growth. Key measures include diversification, transparency, long-term financing, regulatory streamlining, inventory reduction, and technology adoption.

Benefits of Integrating Blockchain Technology in Real Estate

Blockchain improves real estate transactions by addressing long-standing challenges and improving efficiency and security

- Improved Transparency through Blockchain Ledgers: Blockchain’s shared ledger offers real-time access to accurate information. It reduces discrepancies and promotes trust in real estate transactions.

- Enhanced Security with Cryptographic Features: Blockchain technology’s cryptography safeguards data security and immutability. Resulting in minimized unauthorized alterations and fraud in property records and transactions and increased confidence in real estate dealings.

- Elimination of Intermediaries in Property Transactions: Blockchain eliminates intermediaries like banks and escrow services for direct peer-to-peer transactions, reducing costs and expediting processes. This disintermediation streamlines the transaction journey.

- Streamlined Processes: Blockchain simplifies real estate transactions by automating processes, reducing paperwork and time, and benefiting buyers and sellers. This efficiency benefits both buyers and sellers, leading to quicker deal closures.

- Reduction in Transaction Costs: Blockchain reduces transaction costs associated with traditional real estate transactions. Legal fees, administrative expenses, and intermediary charges are minimized, making real estate transactions more cost-effective for all parties involved.

- Enhanced Security and Fraud Prevention: Blockchain technology’s decentralization and tamper-proof nature prevent fraud. Smart contracts automate contractual terms, reducing disputes and fraud.

These benefits collectively contribute to a more efficient, accessible, and secure real estate ecosystem.

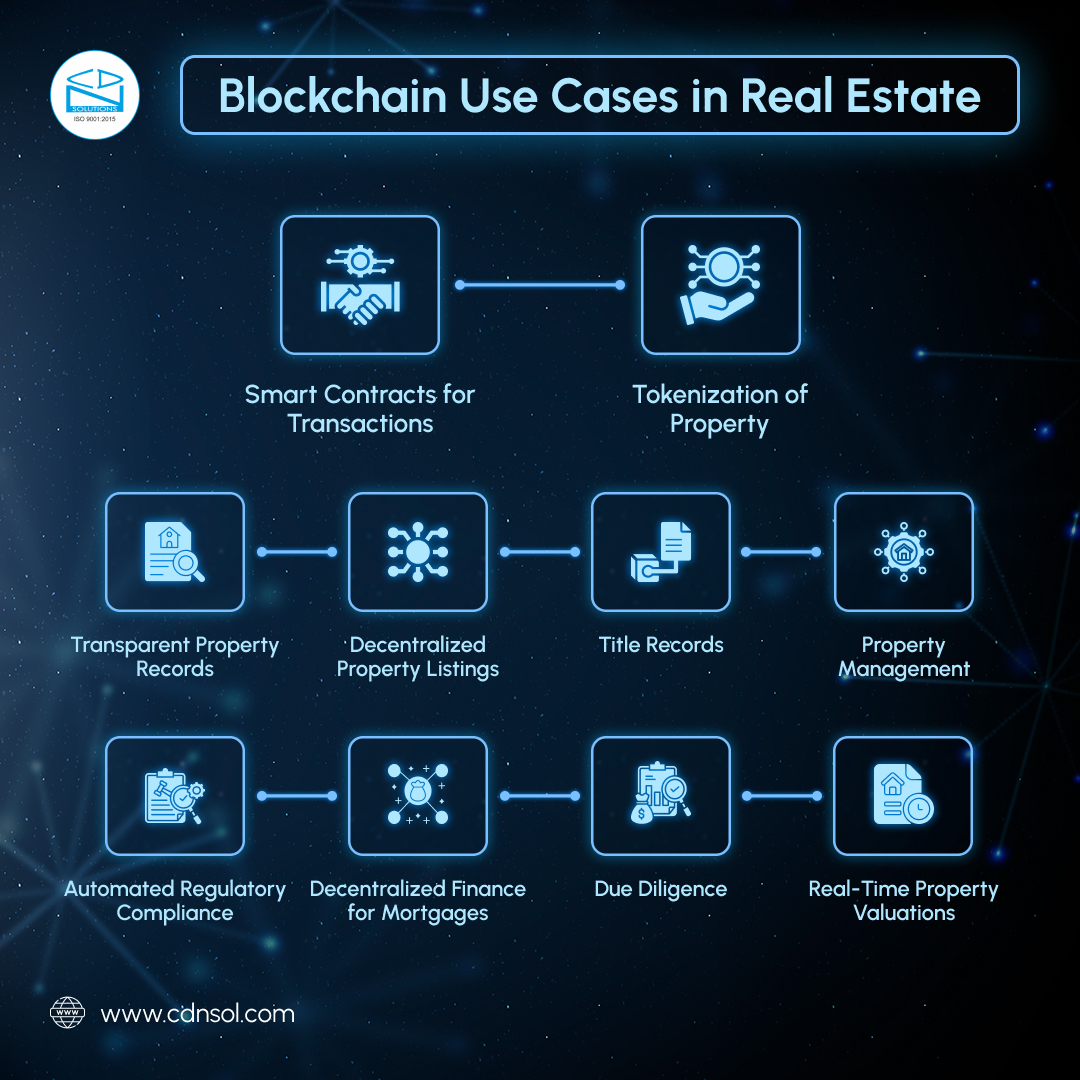

Blockchain Use Cases in Real Estate

- Asset Management: Tokenization in real estate brings a major change by enabling seamless issuance and exchange of digital assets.

- Real-time Accounting: Blockchain affects real-time accounting by creating annual statements through continuous audits. This change brings breakthroughs in compliance, regulation, and investor relations.

- Payments and Leasing: Blockchain in real estate transforms payments, rentals, and dividends. Smart contracts eliminate manual reconciliation, automating processes for increased efficiency in payments and leasing.

- Land and Property Registries: Blockchain revolutionizes land and property registration by offering accurate, efficient, and transparent records, solving the challenges of paper-based systems.

- Investor and Tenant Identity: Blockchain-based digital identities streamline background checks, cut costs, and heighten security for investors and tenants by providing a secure way to prove property ownership.

Global Impact of Blockchain Technology on Real Estate

The profound influence of blockchain technology echoes globally. It is reshaping the landscape of cross-border property transactions, standardizing property data and regulations, and fostering new avenues for international investors. This revolutionary impact of blockchain serves as a catalyst, bringing in positive transformations on a global scale.

Cross-border property transactions undergo a significant improvement with the integration of blockchain. The technology streamlines and expedites the process, providing a transparent and secure platform for recording and verifying property data across different jurisdictions. This simplifies the complexities associated with international real estate dealings and also enhances the efficiency and accessibility of global property transactions.

Establishing a uniform and transparent framework for recording property information, blockchain contributes to a harmonized system that transcends geographical boundaries. This standardization fosters clarity, reduces ambiguity, and promotes a more cohesive approach to real estate regulations across diverse regions.

Data Point

- A Real Estate Blockchain Association study states that integrating blockchain technology with smart contracts can cut expenses by 50% and time by 30%.

- Property-related conflicts have decreased by 80% in nations that use blockchain technology to record property transfers. (Source: Global Blockchain Real Estate Report, 2023)

- The largest asset class, real estate, which is projected to be valued at $613 trillion in 2023, has been greatly influenced by tokenization.

Blockchain and the Future of Real Estate

The potential for innovation and development in blockchain technology hints at a future where real estate transactions are not only streamlined but revolutionized. Its integration with emerging technologies like artificial intelligence (AI) and the Internet of Things (IoT) holds immense promise. The synergy of these technologies creates a dynamic ecosystem where data-driven insights, predictive analytics, and automation redefine the way real estate is managed, operated, and experienced.

The intersection of blockchain with AI holds the potential to enhance decision-making processes within the real estate sector. Smart algorithms and machine learning algorithms, fuelled by blockchain’s secure and transparent data, can revolutionize property valuation, risk assessment, and market predictions. This not only leads to more informed investment decisions but also contributes to the overall resilience and adaptability of the real estate market.

The fusion of blockchain and IoT introduces a new paradigm in property management. Smart contracts, embedded with IoT sensors, can automate tasks related to property maintenance, security, and energy management. This will reduce operational costs and ensure a seamless and responsive real estate environment that caters to the evolving needs of inhabitants.

Predicting the future landscape of the real estate industry also involves foreseeing the continued growth of blockchain adoption. Reports and data suggest a steady upward trajectory in the global market size of blockchain applications in real estate. As the technology becomes more mainstream, its integration into regulatory frameworks and widespread acceptance by governments will play a pivotal role in shaping the industry’s future trajectory.

Adoption Challenges and Opportunities

Integrating blockchain into the real estate sector brings both challenges and opportunities. A nuanced understanding of both is a must for those involved.

The lack of awareness and understanding is a primary hurdle in the widespread adoption of blockchain in real estate. Many industry participants fail to grasp the intricacies and benefits of blockchain technology. Overcoming this initial barrier requires. Comprehensive educational initiatives to enlighten stakeholders about the technology is a requisite.

Resistance to change within the real estate sector is a formidable challenge. Established practices and conventional workflows are deeply ingrained. The industry is resistant to swift transformations.

Educating stakeholders about the benefits of blockchain is not just about overcoming ignorance. It’s also about identifying opportunities for collaboration within the industry. Partnerships and collaborations can streamline the integration of blockchain solutions for the real estate community.

While challenges are apparent, they often serve as gateways to opportunities. Overcoming adoption hurdles can position real estate entities as pioneers in innovation. They can get a competitive edge in operational efficiency. And, establish their brand image as a futuristic and tech-savvy enterprise. Organizations can also capitalize on the untapped potential for efficiency gains, cost reductions, and heightened security that blockchain offers.

Regulatory Challenges and Considerations

Real estate, being a traditionally regulated sector, has a complex web of varying rules across jurisdictions. Navigating through these regulatory nuances is a foundational step in dealing with the landscape. Understanding the current regulatory frameworks, addressing challenges, and identifying opportunities are imperative. It will seamlessly integrate blockchain into the established legal and governance structures.

Both Challenges and opportunities present themselves in this regulatory framework. On one hand, regulatory constraints pose uncertainty, compliance costs, and the need for standardization. On the other, it presents opportunities for refining blockchain solutions to meet the rights and expectations of parties. As key stakeholders, governments play a crucial role in either hindering or facilitating the adoption of blockchain.

- Addressing concerns related to privacy and data protection is an integral on the part of technology.

- Blockchain transactions are inherently transparent. Reconciling this transparency with the privacy requirements mandated by regulations is a task on the part of the government.

In essence, the regulatory challenges and considerations surrounding blockchain in real estate demand a comprehensive exploration.

Real-world Examples of Blockchain in Real Estate

- Harbor: A digital platform called Harbor uses blockchain technology to produce tokenized securities that are backed by actual assets. Founded in 2017, this platform makes sure that tokenized security complies with local security regulations.

- Brickschain: Brickschain allows investors to invest in real estate assets in fractions of their wish. Investors became fractional owners in real estate portfolios. It is like a real estate exchange transforming investment patterns in the real estate industry.

- Bloqhouse: Bloqhouse is a blockchain-based distributed storehouse system. It is fully based on private blockchains. Users can rent out unused storage space to others. Smart Contracts and Proof of Retrievability monitor the hosting process.

- Rentberry: Rentberry is making rental management easier. Rentberry is a decentralized rental ecosystem. It leverages blockchain technology to reduce costs, increase convenience, and provide a more secure rental experience.

- Ubitquity: The groundbreaking technology from UBITQUITY makes it possible to create tamper-proof and unchangeable property records on the blockchain. Due to this, there is now much less chance of fraud and mistakes in real estate transactions.

- Midasium: Midasium has introduced a global ecosystem for real-time property monitoring and the first Virtual Credit Bureau for real estate. Utilizing a decentralized ledger for permanent execution and recording of real estate transactions via smart contracts.

Policy considerations for blockchain integration in real Estate

- Establish a national Blockchain infrastructure with a sandbox for testing solutions.

- Scalable, secure, and privacy-aware data provenance architectures for stakeholders.

- Building capacity and skills to boost technology knowledge and innovation among stakeholders.

- Contributing towards the creation of Intellectual Property Rights (IPR).

- Share technology globally and develop cross-border solutions.

- Contributing towards the development of national and global level standards.

These can create a trusted digital platform, promote research and development, and facilitate transparent, secure, and trusted digital service delivery to citizens and businesses.

Conclusion

Blockchain’s impact on real estate is a transformative journey. It has challenges alongside innovation and opportunities ripe for exploration. The industry is grappling with the integration of this disruptive technology. And, the path forward is one of continual evolution. Blockchain, along with enhancing efficiency and transparency, will reshape the very fabric of real estate transactions.

The combo of artificial intelligence (AI) and the Internet of Things (IoT) promises a dynamic ecosystem. Predictive analytics, data-driven insights, and automation redefine the real estate experience. A futuristic approach will help stakeholders anticipate and embrace a landscape where blockchain shapes the future of the industry.

Challenges surrounding regulatory considerations need a striking balance between technological innovation and compliance. As governments embrace and regulate blockchain transactions, a harmonized framework will emerge. An environment will foster where blockchain can thrive within legal boundaries.

Connecting with IT solution providers like CDN Solution Group is a strategic step toward realizing the untapped potential of blockchain in real estate. As the industry evolves, you are invited to join the conversation, explore the possibilities, and be part of the dynamic transformation that awaits at the intersection of blockchain and real estate.

Also read